Things about Clark Wealth Partners

Table of ContentsFascination About Clark Wealth PartnersThe Clark Wealth Partners PDFsSome Known Incorrect Statements About Clark Wealth Partners All about Clark Wealth PartnersThe 5-Second Trick For Clark Wealth PartnersThe smart Trick of Clark Wealth Partners That Nobody is Talking AboutNot known Facts About Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.

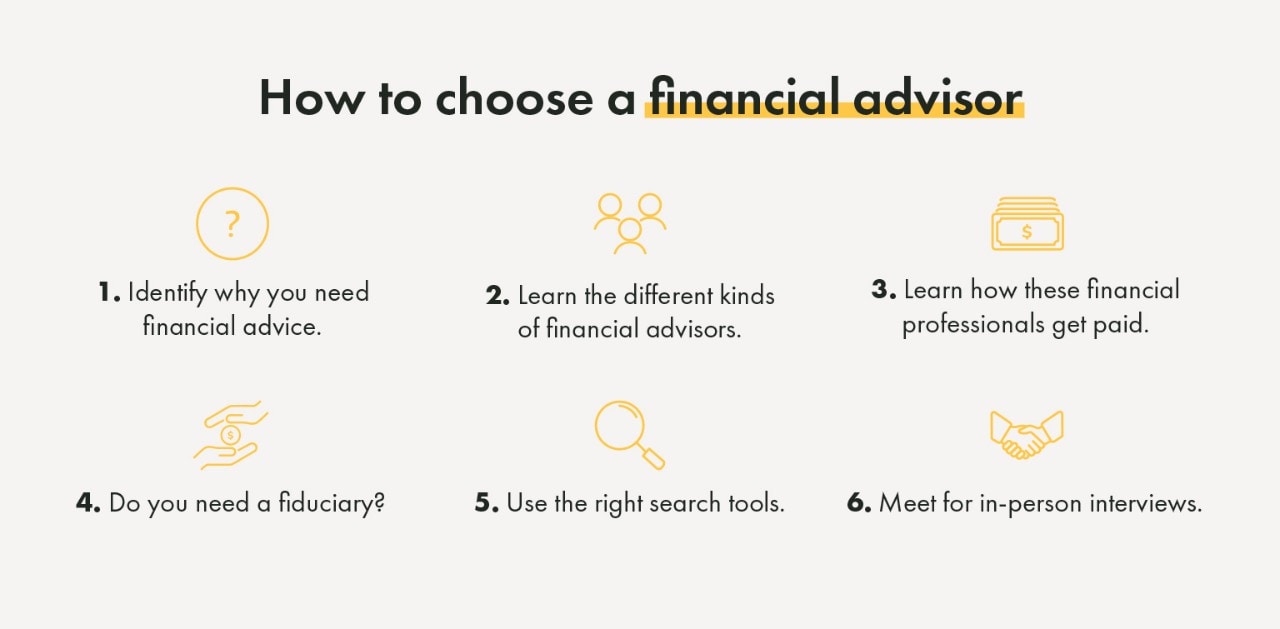

Usual factors to take into consideration an economic advisor are: If your economic circumstance has become more complex, or you lack confidence in your money-managing abilities. Conserving or navigating significant life events like marriage, divorce, kids, inheritance, or work adjustment that may considerably impact your monetary circumstance. Browsing the change from saving for retirement to maintaining riches throughout retired life and exactly how to develop a strong retirement earnings plan.New technology has actually caused even more detailed automated monetary tools, like robo-advisors. It's up to you to check out and figure out the ideal fit - https://www.quora.com/profile/Blanca-Rush. Inevitably, a great economic consultant must be as mindful of your investments as they are with their very own, preventing too much charges, saving cash on tax obligations, and being as clear as possible about your gains and losses

Excitement About Clark Wealth Partners

Earning a commission on item suggestions does not necessarily suggest your fee-based advisor functions versus your ideal interests. They might be much more likely to advise products and services on which they make a payment, which might or might not be in your finest rate of interest. A fiduciary is legally bound to place their client's interests.

They may adhere to a loosely kept an eye on "suitability" requirement if they're not signed up fiduciaries. This standard allows them to make recommendations for investments and solutions as long as they fit their customer's objectives, danger tolerance, and economic scenario. This can equate to referrals that will additionally make them money. On the various other hand, fiduciary experts are lawfully obliged to act in their customer's ideal rate of interest rather than their own.

The Of Clark Wealth Partners

ExperienceTessa reported on all things spending deep-diving into intricate economic topics, clarifying lesser-known investment opportunities, and discovering methods readers can work the system to their advantage. As an individual money specialist in her 20s, Tessa is acutely conscious of the impacts time and unpredictability have on your financial investment decisions.

It was a targeted promotion, and it worked. Learn more Review less.

An Unbiased View of Clark Wealth Partners

There's no single route to coming to be one, with some individuals beginning in financial or insurance policy, while others begin in accounting. A four-year level supplies a strong foundation for jobs in investments, budgeting, and client solutions.

Examine This Report on Clark Wealth Partners

Usual examples include the FINRA Collection 7 and Series 65 exams for protections, or a state-issued insurance permit for offering life navigate to these guys or health and wellness insurance coverage. While credentials might not be legitimately needed for all preparing functions, companies and customers usually watch them as a standard of professionalism. We take a look at optional credentials in the following section.

A lot of monetary planners have 1-3 years of experience and familiarity with economic products, compliance requirements, and straight client communication. A strong academic background is necessary, however experience demonstrates the capacity to use concept in real-world setups. Some programs combine both, permitting you to complete coursework while making supervised hours via internships and practicums.

How Clark Wealth Partners can Save You Time, Stress, and Money.

Numerous enter the area after operating in financial, audit, or insurance coverage, and the change requires perseverance, networking, and frequently advanced qualifications. Very early years can bring lengthy hours, stress to build a customer base, and the requirement to constantly show your knowledge. Still, the occupation uses strong long-term capacity. Financial coordinators delight in the opportunity to function very closely with clients, guide essential life choices, and frequently accomplish adaptability in timetables or self-employment.

Wide range managers can boost their profits with payments, possession charges, and performance bonuses. Monetary managers manage a team of monetary coordinators and advisors, establishing departmental strategy, managing compliance, budgeting, and guiding internal procedures. They spent much less time on the client-facing side of the industry. Almost all economic managers hold a bachelor's level, and several have an MBA or comparable graduate level.

Clark Wealth Partners for Dummies

Optional qualifications, such as the CFP, generally call for extra coursework and screening, which can prolong the timeline by a pair of years. According to the Bureau of Labor Statistics, individual financial consultants make a typical annual annual income of $102,140, with leading income earners making over $239,000.

In other districts, there are policies that need them to satisfy certain needs to utilize the financial expert or monetary organizer titles. For monetary planners, there are 3 common designations: Qualified, Personal and Registered Financial Coordinator.

The 5-Second Trick For Clark Wealth Partners

Those on salary may have a reward to promote the services and products their employers supply. Where to locate a financial consultant will depend on the kind of guidance you need. These institutions have team that might help you recognize and buy specific kinds of financial investments. Term down payments, ensured investment certifications (GICs) and common funds.